El Salvador continues to elevate its commitment to the digital economy, showcasing its capability and expertise in creating highly favorable regulations for the crypto and digital asset environment.

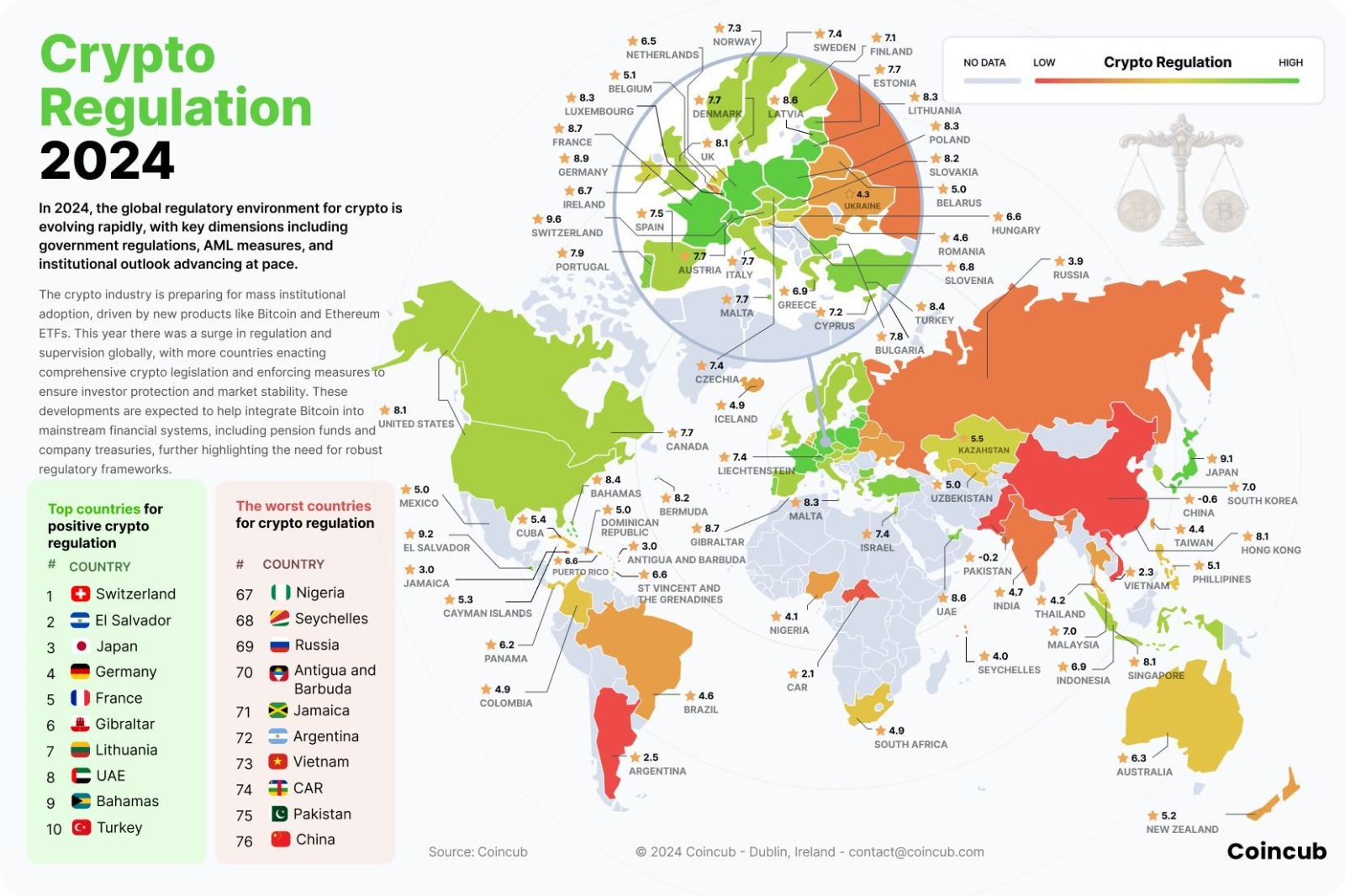

Within the first 300 days of Juan Carlos Reyes’s tenure as President of the National Commission of Digital Assets (CNAD), our country stands out in 2024 for ranking first in the Americas among countries and territories with the best positive and favorable crypto regulation, achieving a score of 9.2 according to the 2024 ranking of the Crypto Asset Regulation Report by Coincub.

This achievement strengthens the work carried out by CNAD in issuing and supervising the application of regulations relevant to the digital asset environment and bolsters the Commission’s vision of creating the best regulatory team in the ecosystem, capable of issuing world-class standards.

El Salvador leads the continental top rankings, followed by the Bahamas with a score of 8.4, Bermuda (8.2), the United States (8.1), and Canada (7.7), while Argentina has the lowest score (2.5).

Globally, only Switzerland, with a score of 9.6, surpasses El Salvador, which is ahead of Japan (9.1), Germany (8.9), France and Gibraltar (8.7), Lithuania (8.3), United Arab Emirates (8.6), the Bahamas, and Turkey (8.4), completing the top 10 worldwide.

The Coincub report indicates that the 2024 classification shows more countries have strengthened their regulatory frameworks for the crypto environment, issuing laws and measures to enhance investor security and market stability. Based in Ireland, Coincub is a platform that offers technical analysis on the crypto economy.

In El Salvador, the National Commission of Digital Assets (CNAD) is the first and only independent entity in the world authorized to regulate and supervise the digital asset market in the country. Its tasks include verifying compliance with the Digital Assets Issuance Law, issuing relevant regulations for the use of cryptocurrencies, tokenizations, and other digital financial instruments, and ensuring market participants adhere to the applicable regulatory framework to provide investor security and market stability, security, and transparency.